Terminal Bonus

The “terminal bonus risk” – do you know if your policy is affected?

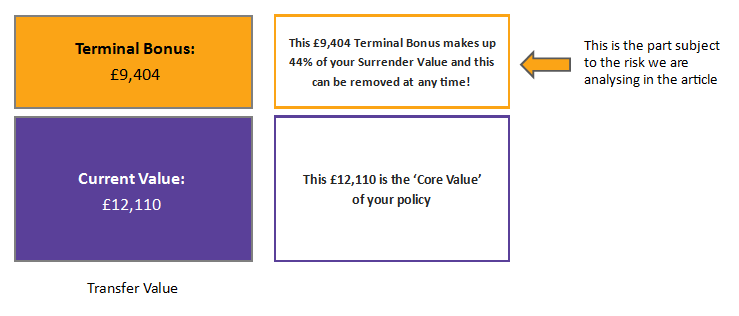

This example of a current with-profits value is a real example, based on a case we recently reviewed. It is typical of millions of policies. What it shows is a split between the core value of the policy and the value which has been enhanced due to a terminal bonus. The terminal bonus amount is constantly subject to reduction or withdrawal.

The diagram above demonstrates a simple position.

A position that will exist for many – probably most – investors who have money in a With-Profits policy or fund.

Are you in this position?

The bonuses being paid to increase the value of a policy are today - more likely than not – to be terminal bonuses. These are sometimes also known as “final bonuses”.

Over the last ten years more and more with-profits companies have changed their approach to allocate returns to you which are based on terminal bonuses not annual bonuses.

The reason?

Terminal bonuses are far easier to reduce or withdraw should asset values within the fund under-perform.

It is our experience that most with-profits policyholders are not aware of this. In other words what looks to be a secure value is not; it can reduce and almost certainly will if markets misbehave and assets start to fall in value.

In the example above over 40% of the current value is a terminal bonus entitlement. This is not unusual.

This 40% is subject to manipulation.

What can the policyholder do to protect against this?

They can transfer, surrender or switch and effectively LOCK DOWN THE TERMINAL BONUS ENTITLEMENT, i.e. take it and secure it. But this requires an action – leaving it will simply keep it at risk.

Is this a sensible move every time? No, not necessarily – there may be factors which suggest leaving it as it is. But this is not the main point.

The main point is this: when we review with-profits policies for savers/investors we commonly find that they do not know that this part of the overall current value is exposed to such a dramatic risk.

And – when they find out that they can do something about this and “lock” in their values, they often do so.

This aspect, what we call the “terminal bonus risk” is just one factor to consider if you are looking at your policy or fund and wondering what to do with it going forward. There can be other factors, positive and negative, to consider which will affect your decision whether to stick or twist.

There is only one way to truly get an accurate and clear overview, which is to have a review of your policy. This review will look at your policy conditions, its current value, how much of this is a terminal bonus, will assess the risks and can set out, for you, the options going forward.

To get such a review you can use our report service; this is a service we provide which will give you all the facts and figures and outline everything you need to know to see what the position is with your policy. All you need to do is complete the short form to kick start this process.