What makes a good with profits policy?

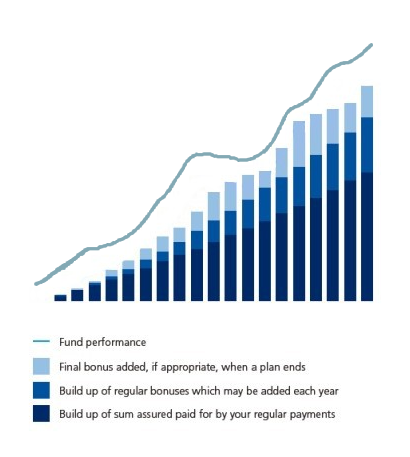

The original with-profits concept was to provide savers/investors with a steady investment with regular bonuses that smooth out the traditional ups and downs of higher risk investing. The with-profits company was given the job of de-risking the investor’s position, smoothing returns over the medium term. To understand this fully think of the concept using this example:

The returns achieved by the with-profits company over 5 years through the underlying investments they choose to make up the with-profits fund look like this:

Yr 1 + 10%

Yr 2 + 20%

Yr 3 - 10%

Yr 4 + 20%

Yr 5 - 10%

Over 5 years this is around a 30% total increase; with-profits is designed so that the investor gets a smoothed performance; therefore in year 1 the with-profits company may decide to declare a bonus of 5% and keep 5% in reserve. In year 2 they may increase the bonus to 8%, keeping 12% in reserve, so after 2 years the investor has received positive returns and the with-profits company have built up some decent reserves.

In year 3 the with-profits company can then use some of those reserves to pay out a positive bonus, maybe 4%. Year 4 they can payout 6% and then again in year 5 they can dig into reserves and payout 5%, producing roughly the same overall return as the fluctuating fund value but in a way that provides regular positive returns for investors.

This is a very simplified example intended to highlight the basic idea. Over long periods of time this managed approach should keep regular bonuses flowing and build reserves for the fund for those rainy days.

It is with this in mind therefore that we can say that a good with-profits company or fund can normally be identified where this concept has been applied successfully and demonstrably over decent periods of time. If you can review your with-profits and see this has worked and is working then it is probable that it is good. You are looking for good regular bonuses, an absence of penalties and strong reserves.

If you spot anything different then it is probable that it is a bad or indifferent with-profits fund.

Nothing will ever answer this question better than getting a detailed and personalised report which can analyse this at an individual level, looking at your specific position.

To get such a report, fill in the form on the right